n the long run, if the firm decides to keep output at its initial level, what will it likely do

Chapter vii. Cost and Industry Structure

vii.3 The Structure of Costs in the Long Run

Learning Objectives

Past the end of this section, y'all will be able to:

- Calculate total toll

- Identify economies of calibration, diseconomies of scale, and constant returns to calibration

- Translate graphs of long-run average price curves and brusque-run average cost curves

- Analyze cost and product in the long run and brusk run

The long run is the period of fourth dimension when all costs are variable. The long run depends on the specifics of the firm in question—information technology is non a precise menstruation of time. If you take a one-yr lease on your mill, so the long run is any menstruum longer than a twelvemonth, since after a year you are no longer bound by the charter. No costs are fixed in the long run. A business firm can build new factories and buy new machinery, or it can close existing facilities. In planning for the long run, the firm will compare alternative production technologies (or processes).

In this context, engineering refers to all alternative methods of combining inputs to produce outputs. It does non refer to a specific new invention similar the tablet computer. The firm will search for the production engineering that allows it to produce the desired level of output at the everyman toll. After all, lower costs lead to higher profits—at least if total revenues remain unchanged. Moreover, each firm must fear that if it does not seek out the lowest-toll methods of production, then information technology may lose sales to competitor firms that find a way to produce and sell for less.

Choice of Production Engineering

Many tasks tin be performed with a range of combinations of labor and concrete capital letter. For instance, a firm can have human beings answering phones and taking letters, or it tin can invest in an automated voicemail system. A house can hire file clerks and secretaries to manage a organization of paper folders and file cabinets, or it can invest in a computerized recordkeeping system that volition require fewer employees. A house can hire workers to push button supplies around a mill on rolling carts, it can invest in motorized vehicles, or it can invest in robots that carry materials without a driver. Firms frequently face a choice between ownership a many pocket-size machines, which need a worker to run each one, or ownership one larger and more than expensive machine, which requires merely one or two workers to operate it. In brusque, physical capital and labor can often substitute for each other.

Consider the instance of a private firm that is hired by local governments to clean up public parks. Three different combinations of labor and physical capital for cleaning upwards a single average-sized park appear in Table vi. The first product engineering is heavy on workers and light on machines, while the next two technologies substitute machines for workers. Since all three of these product methods produce the same affair—one cleaned-up park—a profit-seeking firm will choose the production applied science that is to the lowest degree expensive, given the prices of labor and machines.

| Production technology 1 | 10 workers | two machines |

| Product technology two | 7 workers | 4 machines |

| Production engineering 3 | 3 workers | 7 machines |

| Table 6. Three Ways to Clean a Park | ||

Production applied science ane uses the virtually labor and to the lowest degree mechanism, while product engineering 3 uses the least labor and the nearly machinery. Tabular array 7 outlines 3 examples of how the total cost will change with each production technology every bit the cost of labor changes. Equally the cost of labor rises from example A to B to C, the firm volition cull to substitute away from labor and utilize more than machinery.

| Example A: Workers cost $40, machines price $eighty | |||

| Labor Toll | Machine Cost | Total Cost | |

| Cost of technology 1 | x × $40 = $400 | 2 × $80 = $160 | $560 |

| Cost of engineering science two | 7 × $forty = $280 | 4 × $fourscore = $320 | $600 |

| Toll of engineering science 3 | 3 × $40 = $120 | 7 × $80 = $560 | $680 |

| Instance B: Workers toll $55, machines cost $eighty | |||

| Labor Toll | Machine Cost | Full Cost | |

| Cost of engineering ane | 10 × $55 = $550 | 2 × $lxxx = $160 | $710 |

| Price of technology two | 7 × $55 = $385 | iv × $80 = $320 | $705 |

| Cost of engineering science 3 | 3 × $55 = $165 | 7 × $80 = $560 | $725 |

| Instance C: Workers price $ninety, machines cost $80 | |||

| Labor Toll | Auto Price | Total Cost | |

| Cost of technology 1 | 10 × $90 = $900 | 2 × $80 = $160 | $ane,060 |

| Cost of applied science 2 | 7 × $90 = $630 | 4 × $80 = $320 | $950 |

| Cost of technology 3 | 3 × $90 = $270 | 7 × $eighty = $560 | $830 |

| Table vii. Total Cost with Ascension Labor Costs | |||

Instance A shows the business firm'southward cost calculation when wages are $forty and machines costs are $80. In this case, engineering ane is the low-toll product technology. In case B, wages rising to $55, while the cost of machines does not change, in which case technology 2 is the low-cost production technology. If wages keep rising up to $90, while the price of machines remains unchanged, and so engineering science 3 clearly becomes the depression-price form of production, as shown in instance C.

This instance shows that as an input becomes more expensive (in this case, the labor input), firms will endeavor to conserve on using that input and will instead shift to other inputs that are relatively less expensive. This blueprint helps to explain why the demand curve for labor (or any input) slopes down; that is, equally labor becomes relatively more expensive, profit-seeking firms volition seek to substitute the use of other inputs. When a multinational employer like Coca-Cola or McDonald's sets upwards a bottling plant or a restaurant in a high-wage economic system like the The states, Canada, Nihon, or Western Europe, information technology is likely to utilise production technologies that conserve on the number of workers and focuses more than on machines. Nonetheless, that same employer is likely to use production technologies with more workers and less machinery when producing in a lower-wage country like Mexico, China, or South Africa.

Economies of Calibration

In one case a firm has determined the least plush production technology, it can consider the optimal calibration of product, or quantity of output to produce. Many industries experience economies of scale. Economies of scale refers to the situation where, as the quantity of output goes up, the price per unit goes downwardly. This is the idea behind "warehouse stores" similar Costco or Walmart. In everyday linguistic communication: a larger factory can produce at a lower average toll than a smaller manufacturing plant.

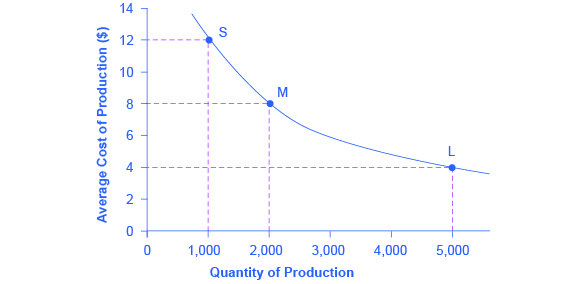

Figure 1 illustrates the thought of economies of scale, showing the average cost of producing an alarm clock falling equally the quantity of output rises. For a pocket-size-sized manufactory like Due south, with an output level of ane,000, the average cost of production is $12 per alarm clock. For a medium-sized factory like M, with an output level of 2,000, the average price of production falls to $eight per alarm clock. For a large factory like L, with an output of five,000, the average cost of production declines still farther to $4 per alarm clock.

The boilerplate cost curve in Figure 1 may appear similar to the average cost curves presented before in this affiliate, although information technology is down-sloping rather than U-shaped. But in that location is one major difference. The economies of calibration curve is a long-run average cost curve, considering it allows all factors of production to change. The brusque-run average price curves presented earlier in this chapter causeless the existence of stock-still costs, and only variable costs were allowed to alter.

I prominent instance of economies of scale occurs in the chemic manufacture. Chemical plants have a lot of pipes. The cost of the materials for producing a pipe is related to the circumference of the pipe and its length. However, the volume of chemicals that can flow through a pipage is determined by the cross-section surface area of the pipe. The calculations in Table 8 show that a pipe which uses twice as much material to make (as shown by the circumference of the piping doubling) can really carry 4 times the book of chemicals because the cantankerous-section expanse of the pipe rises by a factor of 4 (as shown in the Area column).

| Circumference (2πr2πr) | Surface area (πr2πr2) | |

|---|---|---|

| iv-inch pipe | 12.5 inches | 12.5 foursquare inches |

| 8-inch pipe | 25.1 inches | 50.2 square inches |

| 16-inch pipe | 50.2 inches | 201.ane foursquare inches |

| Table 8. Comparing Pipes: Economies of Calibration in the Chemical Industry | ||

A doubling of the cost of producing the pipe allows the chemical house to procedure 4 times every bit much textile. This blueprint is a major reason for economies of scale in chemic product, which uses a big quantity of pipes. Of grade, economies of scale in a chemical found are more than complex than this simple adding suggests. But the chemic engineers who design these plants accept long used what they call the "vi-tenths dominion," a rule of thumb which holds that increasing the quantity produced in a chemical plant by a sure per centum volition increase total cost by merely half-dozen-tenths equally much.

Shapes of Long-Run Boilerplate Cost Curves

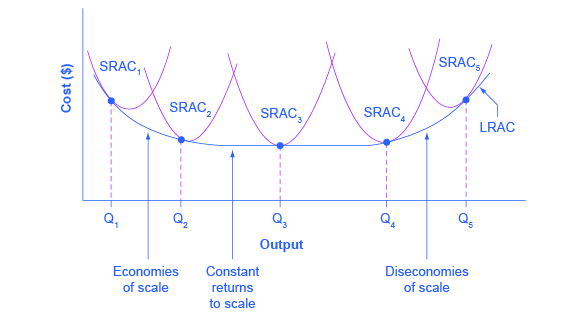

While in the short run firms are limited to operating on a single boilerplate toll curve (corresponding to the level of fixed costs they take called), in the long run when all costs are variable, they can choose to operate on any average cost curve. Thus, the long-run average price (LRAC) curve is actually based on a group of short-run boilerplate cost (SRAC) curves, each of which represents one specific level of stock-still costs. More precisely, the long-run average cost bend will exist the least expensive boilerplate cost curve for whatever level of output. Figure 2 shows how the long-run average cost bend is built from a group of short-run boilerplate cost curves. Five short-run-average cost curves appear on the diagram. Each SRAC curve represents a different level of stock-still costs. For instance, you tin can imagine SRAC1 as a small factory, SRAC2 every bit a medium factory, SRAC3 equally a big manufacturing plant, and SRAC4 and SRAC5 as very large and ultra-large. Although this diagram shows only five SRAC curves, presumably there are an infinite number of other SRAC curves betwixt the ones that are shown. This family of short-run average cost curves tin exist thought of as representing different choices for a business firm that is planning its level of investment in fixed cost physical capital—knowing that unlike choices about capital investment in the nowadays will crusade it to end up with dissimilar brusque-run average cost curves in the future.

The long-run average cost curve shows the cost of producing each quantity in the long run, when the firm can choose its level of fixed costs and thus choose which brusk-run average costs it desires. If the firm plans to produce in the long run at an output of Q3, information technology should make the set of investments that will pb it to locate on SRAC3, which allows producing qthree at the everyman cost. A firm that intends to produce Q3 would be foolish to choose the level of stock-still costs at SRACii or SRAC4. At SRAC2 the level of stock-still costs is too low for producing Q3 at lowest possible toll, and producing qiii would require adding a very high level of variable costs and make the average cost very high. At SRAC4, the level of stock-still costs is too loftier for producing qiii at lowest possible cost, and over again average costs would be very loftier as a result.

The shape of the long-run cost curve, as fatigued in Effigy 2, is adequately mutual for many industries. The left-hand portion of the long-run average cost curve, where it is downwardly- sloping from output levels Qane to Q2 to Qthree, illustrates the case of economies of scale. In this portion of the long-run average toll curve, larger scale leads to lower boilerplate costs. This pattern was illustrated earlier in Effigy one.

In the middle portion of the long-run average cost curve, the apartment portion of the curve around Qiii, economies of scale have been wearied. In this situation, allowing all inputs to expand does not much change the average cost of production, and it is called constant returns to scale. In this range of the LRAC curve, the average cost of production does non change much as scale rises or falls. The post-obit Articulate it Upwardly feature explains where diminishing marginal returns fit into this analysis.

How do economies of scale compare to diminishing marginal returns?

The concept of economies of scale, where average costs decline every bit product expands, might seem to conflict with the idea of diminishing marginal returns, where marginal costs ascension equally production expands. But diminishing marginal returns refers only to the short-run average cost curve, where one variable input (like labor) is increasing, only other inputs (like capital) are fixed. Economies of scale refers to the long-run average cost curve where all inputs are being allowed to increment together. Thus, information technology is quite possible and mutual to have an manufacture that has both diminishing marginal returns when just 1 input is allowed to change, and at the aforementioned time has increasing or abiding economies of calibration when all inputs alter together to produce a larger-scale operation.

Finally, the correct-hand portion of the long-run average cost curve, running from output level Q4 to Qfive, shows a situation where, as the level of output and the scale rises, average costs rise as well. This situation is called diseconomies of scale. A firm or a factory can grow so large that it becomes very difficult to manage, resulting in unnecessarily high costs as many layers of direction try to communicate with workers and with each other, and as failures to communicate pb to disruptions in the menstruation of work and materials. Not many overly large factories exist in the real world, because with their very loftier product costs, they are unable to compete for long confronting plants with lower average costs of production. All the same, in some planned economies, like the economic system of the old Soviet Union, plants that were then large as to be grossly inefficient were able to go along operating for a long time considering government economic planners protected them from competition and ensured that they would not make losses.

Diseconomies of scale can as well be nowadays beyond an entire firm, non merely a big mill. The leviathan effect can hit firms that become too big to run efficiently, across the entirety of the enterprise. Firms that compress their operations are frequently responding to finding itself in the diseconomies region, thus moving back to a lower average cost at a lower output level.

Visit this website to read an article about the complication of the belief that banks can be "too-big-to-fail."

The Size and Number of Firms in an Industry

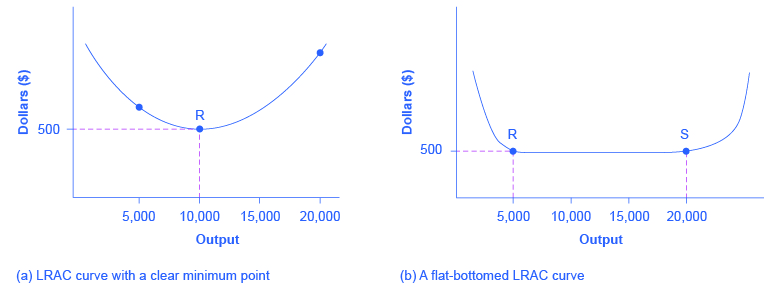

The shape of the long-run average price curve has implications for how many firms will compete in an industry, and whether the firms in an industry have many different sizes, or tend to exist the same size. For example, say that one million dishwashers are sold every year at a cost of $500 each and the long-run average toll curve for dishwashers is shown in Figure 3 (a). In Figure 3 (a), the everyman betoken of the LRAC bend occurs at a quantity of 10,000 produced. Thus, the market for dishwashers volition consist of 100 different manufacturing plants of this same size. If some firms congenital a plant that produced v,000 dishwashers per twelvemonth or 25,000 dishwashers per year, the average costs of production at such plants would be well higher up $500, and the firms would not be able to compete.

How can cities exist viewed as examples of economies of scale?

Why are people and economic activity concentrated in cities, rather than distributed evenly across a state? The fundamental reason must be related to the idea of economies of calibration—that group economic activity is more than productive in many cases than spreading it out. For example, cities provide a large group of nearby customers, so that businesses can produce at an efficient economy of scale. They likewise provide a big group of workers and suppliers, then that business tin hire easily and purchase whatever specialized inputs they need. Many of the attractions of cities, like sports stadiums and museums, can operate only if they can depict on a big nearby population base. Cities are large enough to offer a wide variety of products, which is what many shoppers are looking for.

These factors are not exactly economies of scale in the narrow sense of the production function of a unmarried firm, but they are related to growth in the overall size of population and market in an area. Cities are sometimes called "agglomeration economies."

These agglomeration factors help to explain why every economy, as it develops, has an increasing proportion of its population living in urban areas. In the Usa, about 80% of the population at present lives in metropolitan areas (which include the suburbs around cities), compared to just 40% in 1900. However, in poorer nations of the world, including much of Africa, the proportion of the population in urban areas is only about 30%. I of the keen challenges for these countries as their economies grow volition be to manage the growth of the slap-up cities that volition ascend.

If cities offer economical advantages that are a course of economies of calibration, then why don't all or most people live in ane giant urban center? At some bespeak, agglomeration economies must turn into diseconomies. For example, traffic congestion may attain a indicate where the gains from being geographically nearby are balanced by how long it takes to travel. High densities of people, cars, and factories can mean more garbage and air and water pollution. Facilities like parks or museums may become overcrowded. There may exist economies of scale for negative activities like crime, considering high densities of people and businesses, combined with the greater impersonality of cities, brand information technology easier for illegal activities equally well every bit legal ones. The future of cities, both in the United States and in other countries around the earth, will be determined past their power to do good from the economies of agglomeration and to minimize or counterbalance the corresponding diseconomies.

A more common case is illustrated in Effigy 3 (b), where the LRAC curve has a flat-bottomed area of constant returns to calibration. In this situation, any house with a level of output between 5,000 and 20,000 volition exist able to produce at nigh the same level of average toll. Given that the market will demand ane 1000000 dishwashers per year at a cost of $500, this market might have equally many as 200 producers (that is, one million dishwashers divided by firms making v,000 each) or as few as 50 producers (one meg dishwashers divided by firms making twenty,000 each). The producers in this market will range in size from firms that brand v,000 units to firms that make 20,000 units. Merely firms that produce below 5,000 units or more than 20,000 volition be unable to compete, because their average costs will be too high. Thus, if nosotros see an industry where well-nigh all plants are the same size, information technology is likely that the long-run average cost bend has a unique bottom point equally in Effigy iii (a). Nevertheless, if the long-run average cost bend has a wide flat lesser like Figure 3 (b), and then firms of a variety of different sizes will be able to compete with each other.

The apartment section of the long-run boilerplate cost curve in Figure iii (b) tin exist interpreted in ii unlike ways. 1 estimation is that a single manufacturing plant producing a quantity of 5,000 has the same boilerplate costs as a single manufacturing found with iv times as much capacity that produces a quantity of 20,000. The other interpretation is that ane firm owns a single manufacturing found that produces a quantity of v,000, while another firm owns four separate manufacturing plants, which each produce a quantity of 5,000. This 2nd explanation, based on the insight that a unmarried firm may own a number of different manufacturing plants, is especially useful in explaining why the long-run boilerplate toll curve frequently has a large flat segment—and thus why a seemingly smaller firm may exist able to compete quite well with a larger firm. At some point, withal, the chore of coordinating and managing many unlike plants raises the toll of production sharply, and the long-run average toll curve slopes up as a result.

In the examples to this betoken, the quantity demanded in the market is quite large (ane meg) compared with the quantity produced at the lesser of the long-run average cost curve (v,000, x,000 or twenty,000). In such a state of affairs, the market is ready for contest between many firms. But what if the lesser of the long-run average cost bend is at a quantity of x,000 and the total market demand at that cost is only slightly higher than that quantity—or even somewhat lower?

Return to Effigy 3 (a), where the bottom of the long-run average cost curve is at ten,000, just now imagine that the total quantity of dishwashers demanded in the marketplace at that toll of $500 is but 30,000. In this situation, the total number of firms in the market would be three. A handful of firms in a market is called an "oligopoly," and the chapter on Monopolistic Competition and Oligopoly will discuss the range of competitive strategies that tin occur when oligopolies compete.

Alternatively, consider a situation, again in the setting of Effigy 3 (a), where the bottom of the long-run average cost curve is 10,000, but total need for the product is simply 5,000. (For simplicity, imagine that this demand is highly inelastic, and then that it does not vary according to price.) In this state of affairs, the marketplace may well end up with a single firm—a monopoly—producing all 5,000 units. If whatever house tried to challenge this monopoly while producing a quantity lower than 5,000 units, the prospective competitor business firm would have a higher average toll, so it would not be able to compete in the longer term without losing money. The affiliate on Monopoly discusses the situation of a monopoly firm.

Thus, the shape of the long-run average toll curve reveals whether competitors in the market will exist different sizes. If the LRAC bend has a unmarried point at the bottom, then the firms in the market will be virtually the aforementioned size, but if the LRAC bend has a flat-bottomed segment of constant returns to scale, then firms in the market may be a multifariousness of dissimilar sizes.

The relationship between the quantity at the minimum of the long-run boilerplate cost curve and the quantity demanded in the marketplace at that cost will predict how much competition is likely to exist in the market place. If the quantity demanded in the market far exceeds the quantity at the minimum of the LRAC, and so many firms will compete. If the quantity demanded in the market is only slightly college than the quantity at the minimum of the LRAC, a few firms will compete. If the quantity demanded in the market is less than the quantity at the minimum of the LRAC, a single-producer monopoly is a probable consequence.

Shifting Patterns of Long-Run Average Toll

New developments in product technology can shift the long-run average price bend in ways that can alter the size distribution of firms in an industry.

For much of the twentieth century, the most common change has been to see alterations in technology, like the assembly line or the large section shop, where large-scale producers seemed to gain an advantage over smaller ones. In the long-run average cost bend, the downward-sloping economies of scale portion of the curve stretched over a larger quantity of output.

However, new product technologies do non inevitably lead to a greater average size for firms. For case, in recent years some new technologies for generating electricity on a smaller scale have appeared. The traditional coal-burning electricity plants needed to produce 300 to 600 megawatts of power to exploit economies of calibration fully. Still, high-efficiency turbines to produce electricity from burning natural gas can produce electricity at a competitive price while producing a smaller quantity of 100 megawatts or less. These new technologies create the possibility for smaller companies or plants to generate electricity as efficiently equally large ones. Another example of a applied science-driven shift to smaller plants may be taking identify in the tire industry. A traditional mid-size tire plant produces about six one thousand thousand tires per year. However, in 2000, the Italian company Pirelli introduced a new tire factory that uses many robots. The Pirelli tire plant produced but most 1 one thousand thousand tires per yr, but did then at a lower average cost than a traditional mid-sized tire institute.

Controversy has simmered in recent years over whether the new information and communications technologies will lead to a larger or smaller size for firms. On ane side, the new applied science may make information technology easier for small firms to reach out beyond their local geographic area and detect customers beyond a country, or the nation, or even across international boundaries. This factor might seem to predict a future with a larger number of small competitors. On the other side, perhaps the new information and communications technology volition create "winner-take-all" markets where one large visitor will tend to command a large share of total sales, as Microsoft has washed in the product of software for personal computers or Amazon has done in online bookselling. Moreover, improved information and communication technologies might arrive easier to manage many different plants and operations across the country or around the world, and thus encourage larger firms. This ongoing boxing between the forces of smallness and largeness will exist of great interest to economists, businesspeople, and policymakers.

Amazon

Traditionally, bookstores take operated in retail locations with inventories held either on the shelves or in the back of the store. These retail locations were very pricey in terms of rent. Amazon has no retail locations; it sells online and delivers by mail service. Amazon offers almost whatsoever book in print, convenient purchasing, and prompt delivery by mail. Amazon holds its inventories in huge warehouses in low-rent locations around the earth. The warehouses are highly computerized using robots and relatively low-skilled workers, making for depression average costs per auction. Amazon demonstrates the significant advantages economies of scale can offer to a business firm that exploits those economies.

Key Concepts and Summary

A production technology refers to a specific combination of labor, physical capital, and applied science that makes up a particular method of production.

In the long run, firms can cull their production technology, and and so all costs go variable costs. In making this choice, firms will endeavour to substitute relatively inexpensive inputs for relatively expensive inputs where possible, so as to produce at the lowest possible long-run average cost.

Economies of scale refers to a situation where as the level of output increases, the average price decreases. Abiding returns to calibration refers to a situation where boilerplate cost does not change as output increases. Diseconomies of scale refers to a situation where as output increases, average costs increment as well.

The long-run average toll curve shows the lowest possible average cost of production, allowing all the inputs to production to vary so that the house is choosing its production technology. A downward-sloping LRAC shows economies of scale; a flat LRAC shows abiding returns to scale; an upward-sloping LRAC shows diseconomies of scale. If the long-run average price curve has only ane quantity produced that results in the lowest possible average toll, then all of the firms competing in an industry should be the same size. However, if the LRAC has a flat segment at the lesser, so that a range of dissimilar quantities can be produced at the everyman average cost, the firms competing in the manufacture volition display a range of sizes. The market demand in conjunction with the long-run average cost curve determines how many firms will exist in a given industry.

If the quantity demanded in the market place of a certain production is much greater than the quantity constitute at the bottom of the long-run average cost curve, where the cost of production is lowest, the marketplace volition have many firms competing. If the quantity demanded in the market is less than the quantity at the bottom of the LRAC, there will likely exist only one firm.

Self-Check Questions

- Return to the trouble explained in Table 6 and Table vii. If the price of labor remains at $forty, but the cost of a automobile decreases to $50, what would be the total toll of each method of production? Which method should the firm apply, and why?

- Suppose the toll of machines increases to $55, while the cost of labor stays at $40. How would that affect the full toll of the three methods? Which method should the business firm cull at present?

- Automobile manufacturing is an industry subject to significant economies of scale. Suppose there are iv domestic car manufacturers, but the demand for domestic autos is no more two.5 times the quantity produced at the bottom of the long-run boilerplate price bend. What do you look will happen to the domestic auto industry in the long run?

Review Questions

- What shapes would you generally wait each of the following cost curves to have: stock-still costs, variable costs, marginal costs, boilerplate total costs, and average variable costs?

- What is a production technology?

- In choosing a production technology, how will firms react if one input becomes relatively more expensive?

- What is a long-run average toll bend?

- What is the divergence between economies of scale, constant returns to scale, and diseconomies of calibration?

- What shape of a long-run average cost bend illustrates economies of scale, constant returns to scale, and diseconomies of scale?

- Why will firms in virtually markets be located at or close to the bottom of the long-run average toll curve?

Critical Thinking Questions

- It is clear that businesses operate in the short run, but practise they ever operate in the long run? Talk over.

- How would an improvement in technology, like the high-efficiency gas turbines or Pirelli tire found, affect the long-run boilerplate cost curve of a business firm? Can you lot describe the onetime curve and the new one on the same axes? How might such an improvement touch other firms in the industry?

- Practise you lot think that the taxicab industry in big cities would be subject area to significant economies of scale? Why or why not?

Problems

Issues

A small visitor that shovels sidewalks and driveways has 100 homes signed up for its services this wintertime. It can use various combinations of capital letter and labor: lots of labor with manus shovels, less labor with snow blowers, and still less labor with a pickup truck that has a snowplow on front. To summarize, the method choices are:

Method 1: 50 units of labor, 10 units of uppercase

Method 2: xx units of labor, 40 units of capital

Method 3: ten units of labor, 70 units of capital

If hiring labor for the winter costs $100/unit and a unit of capital letter costs $400, what production method should exist chosen? What method should be chosen if the cost of labor rises to $200/unit?

Glossary

- constant returns to scale

- expanding all inputs proportionately does not modify the average price of production

- diseconomies of calibration

- the long-run boilerplate toll of producing each private unit increases as total output increases

- long-run boilerplate cost (LRAC) bend

- shows the lowest possible boilerplate toll of production, assuasive all the inputs to product to vary and so that the business firm is choosing its production technology

- production technologies

- culling methods of combining inputs to produce output

- brusk-run average toll (SRAC) curve

- the average full toll curve in the short term; shows the total of the average stock-still costs and the average variable costs

Solutions

Answers to Cocky-Check Questions

- The new tabular array should look like this:

Labor Toll Machine Cost Total Cost Cost of applied science 1 ten × $xl = $400 2 × $fifty = $100 $500 Cost of technology 2 7 × $40 = $280 4 × $50 = $200 $480 Cost of engineering 3 3 × $40 = $120 7 × $50 = $350 $470 Table 9. The firm should choose production technology 3 since information technology has the lowest full cost. This makes sense since, with cheaper car hours, ane would await a shift in the management of more machines and less labor.

-

Labor Toll Car Cost Total Cost Cost of engineering science 1 10 × $xl = $400 ii × $55 = $110 $510 Cost of technology 2 seven × $40 = $280 iv × $55 = $220 $500 Cost of engineering science 3 three × $40 = $120 7 × $55 = $385 $505 Table 10. The firm should choose production engineering science 2 since it has the lowest total price. Considering the price of machines increased (relative to the previous question), you would wait a shift toward less capital and more labor.

- This is the situation that existed in the United States in the 1970s. Since in that location is only demand plenty for 2.5 firms to reach the bottom of the average cost curve, yous would expect one firm will not be effectually in the long run, and at least one firm will be struggling.

mcmillanequaringer.blogspot.com

Source: https://opentextbc.ca/principlesofeconomics/chapter/7-3-the-structure-of-costs-in-the-long-run/

0 Response to "n the long run, if the firm decides to keep output at its initial level, what will it likely do"

Post a Comment